The Singapore 2024 budget introduces impactful measures for businesses, especially Small and Medium Enterprises (SMEs). Notable highlights include:

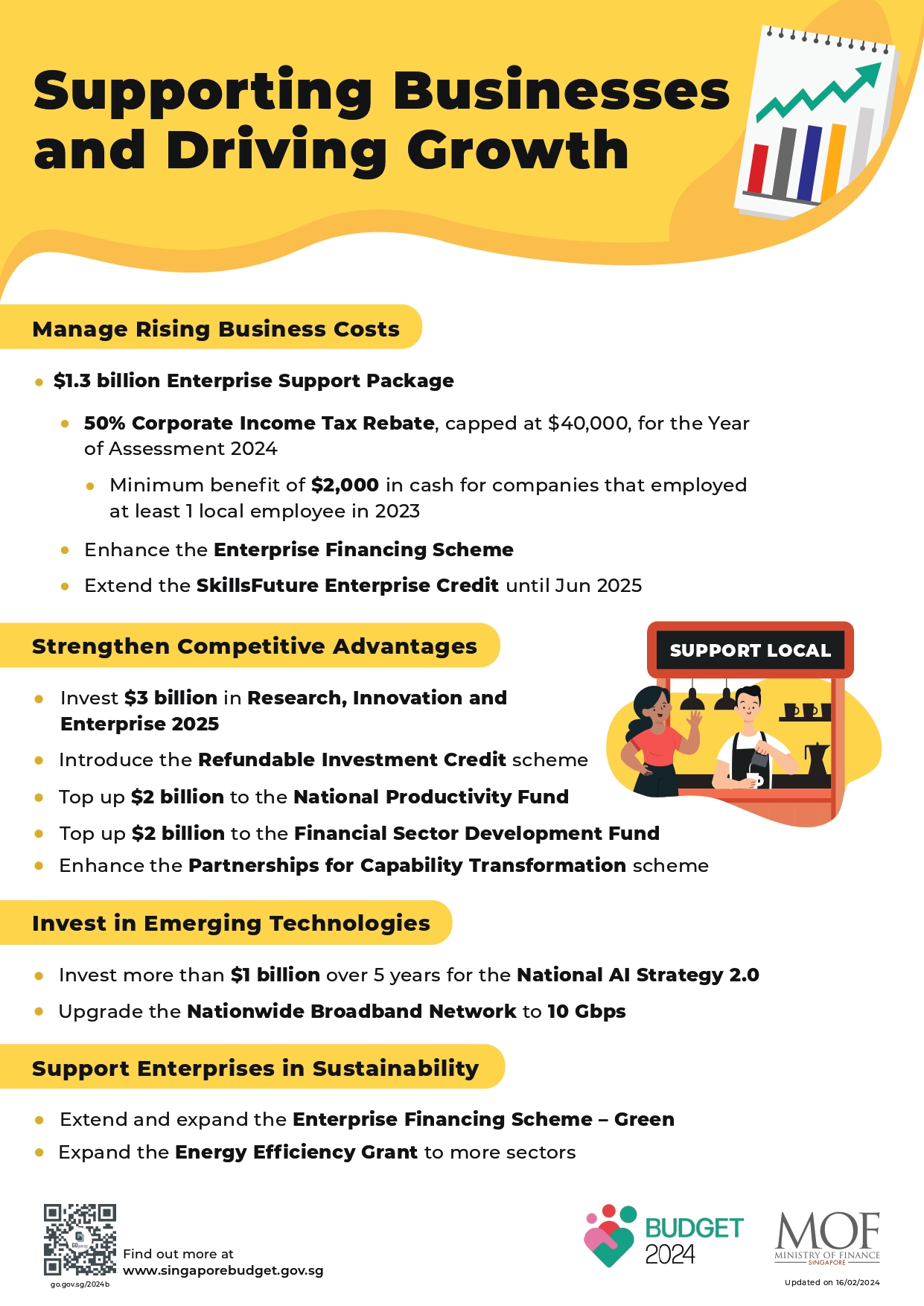

- Enterprise Support Package: A substantial S$1.3 billion allocation aimed at supporting businesses.

- Corporate Income Tax Rebate: SMEs will benefit from a 50% corporate income tax rebate capped at S$40,000 for the year of assessment 2024.

- Minimum Cash Payout: Companies with at least one local employee in 2023 are eligible for a S$2,000 minimum cash payout.

- Enhancements to Enterprise Financing Scheme: The maximum working capital loan quantum is permanently raised to S$500,000. The enhanced maximum trade loan quantum and government risk-sharing of project loans are extended to March 31, 2025.

- SkillsFuture Enterprise Credit (SFEC) Extension: The SkillsFuture Enterprise Credit is extended to June 30, 2025.

- Mid-Career SkillsFuture Level-Up Programme: A S$4,000 SkillsFuture Credit (Mid-Career) top-up from May 2024, along with subsidies for pursuing another full-time diploma and a training allowance.

The overall focus of the budget is on sustainability, talent development, and artificial intelligence (AI), aligning with a vision for a tech-forward future. In response, SGTech, a technology industry association, expresses eagerness to collaborate for Singapore’s technological leadership. They stress the importance of strategic tech talent development, voluntary sustainability compliance, and industry-standard reporting guidelines.

SGTech acknowledges the ongoing implementation of SkillsFuture, believing it will incentivize mid-career workers to update their skills. They advocate for private sector collaboration with government agencies to establish standards and recognition for on-the-job learning.

Regarding the green transition, SGTech welcomes the New Tax Credit to incentivize environmentally sustainable practices. They emphasize the importance of working with industry partners and government agencies to establish industry sustainability reporting standards.

On digital trust, SGTech recognizes the establishment of the National Cybersecurity Command Centre as a crucial step. They propose the appointment of a Chief Trust Officer and emphasize the need for targeted investments, private sector partnerships, and awareness initiatives to enhance cybersecurity.

Drawing from our extensive experience as a Productivity Solution Grant (PSG) vendor for over 5 years, coupled with numerous interactions involving the Enterprise Development Grant (EDG) and Company Training Committee (CTC) grant, we are excited about the prospect of the SkillsFuture Enterprise Credit (SFEC) extension. In our view, this extension not only applies to SFEC but is likely to encompass PSG and EDG as well.

This extension opens up valuable opportunities for businesses. Instead of letting your SFEC go unused, seize the chance to use the budget to revamp website and make it ecommerce-enabled, develop customized applications, delve into digital marketing, and enhance your CRM, Accounting, and HR solutions. The beauty of SFEC lies in its coverage, where it can support up to 90% of out-of-pocket expenses on qualifying costs for various initiatives. Don’t miss out on the chance to leverage these grants for the growth and transformation of your business.

In summary, the Singapore 2024 budget aims to bolster SMEs through financial support, promote sustainability, enhance skills development, and strengthen digital trust, with Digital Business Network actively engaging in collaborative efforts to realize these objectives and contribute to the overall economic ecosystem.